Blog

This blog contains information and items for further discussion regarding questions raised on the Facebook Group Payroll Matters in Ireland.

------

Preliminary End of

Year Statements

6 Important Points About

Your Income Tax Return

Claim Tax Back in Ireland on Health Expenses and Nursing Home

Expenses in Real Time

Tax Credit Certificates

Tax

Treatment of Employment Flat Rate Expenses

The

PPS Number Entered Cannot Access MyAccount

Cohabiting Couples Income Tax Treatment

Complete Income Tax Return

Split Income Tax Credits Between Jobs

or Private Pensions

Inform Revenue That You Are A Medical Card Holder

Parent’s Benefit

Employment Status of Employee or Self-Employed Determination

Employee on Pay as You Earn (PAYE) V Self Employed on Relevant

Contracts Tax (RCT)

Band 1 Credit Reduction

Public Holidays Ireland

Calculate Reduction in Tax Rate Band and Tax Credits for PUP

Taxation of Maternity

Benefit

2020 PAYE and USC End of

Year Balance

Tips and the Payment of Wages (Amendment) (Tips and Gratuities)

Act 2022

Preliminary End of Year Statements

To view your Preliminary End of Year

Statement, you must:

If you wish to claim health expenses by completing a tax return we have a Step-by-Step Guide video

which can be used for any year on How to Complete an

Income Tax Return + Claim Tax Back.

------

6 Important Points About Your Income Tax Return

2. As a taxpayer you cannot assign your

tax compliance responsibilities to a tax

practitioner, tax agent, tax rebate or tax back company.

3

4.

You can claim relief on the cost of health expenses. These can be your own health expenses or those of a family member, as long as you paid for them. You cannot claim relief for any amounts that you have already received, or will receive from:>

>

>

5. You must keep all relevant

documentation to support claims for tax credits, reliefs,

allowances, etc. (e.g. as a taxpayer claiming medical expenses

you must

have receipts to support the expenses claimed). All supporting

documentation must be kept for a period of six years from the

end of the year to which the claim or liability refers. Where

you upload receipts to the receipts tracker in myAccount or

through ROS, you do not need to keep the original receipts.

6. You should keep Revenue informed of any changes in basic personal details such as a change of address as well as changes in yourr circumstances that may affect your entitlement to a tax credit(s). In particular, significant “life events” such as:, marriage or civil partnership, cohabitation, separation, or bereavement should be brought to Revenue’s attention as soon as possible.

See the video on our Youtube Channel Important Points About Completing Income Tax Returns------

Claim Tax Back in Ireland on Health Expenses and Nursing Home

Expenses in Real Time

A Real Time

Credit facility is available on Revevenue to claim Health

Expenses and Nursing Home expenses as they are incurred rather

than waiting until the end of the year. Use the 'Manage Your

Tax' link to make a claim.

You can make a real time claim once you

have incurred qualifying expenditure. A readable image of each

receipt must be uploaded to the Receipts Tracker. The Receipts

Tracker is in the PAYE Services and Manage My Record cards in

myAccount.

> select Add a new receipt

> input the expenses you paid

> upload your receipt following the instructions on the page

When your claim has been processed, an

amended Revenue Payroll Notification (RPN) will be made

available to your employer. An amended Tax Credit Certificate

(TCC) will also issue to you.

If you wish to claim at the end of the year you can complete an income tax return, we have a Step-by-Step Guide video

which can be used for any year on How to Complete an

Income Tax Return + Claim Tax Back

------

Tax Credit Certificates

Tax Credit Certificates used to be

delivered by post through your letterbox but are now notified to

you via your inbox. Revenue is currently in the process of

sending out notification emails to thousands of PAYE workers

every day to advise them that they have a new notification in

their inbox on their Revenue MyAccount. There are many people

who don't bother looking at these notifications for one reason

or another. The main reason however is that they don't know how.

We here at BPPM and Payroll Matters in Ireland have increasing

numbers asking questions about these certificates, and we are

happy to answer any question or clarify any issues. Here are a

few of the most frequently asked questions.

HOW TO VIEW MY TAX CREDIT CERTIFICATE ONLINE

If you are a Pay As You Earn (PAYE)

customer, you can view, download or print your Tax Credit

Certificates from My Documents. My Documents is a facility in

myAccount to store certain documents. You can access it on the

ribbon running across the top of the myAccount home page or from

the ‘Manage My Record’ card. If you have any unread

documentation, an orange circle will display on the My Documents

folder icon. When you access the service from a desktop or

mobile device, you may need to amend your browser settings to

allow pop up messages. This will allow you to access your

documents.

HOW TO ACCESS REVENUE PAYE SERVICE

My Documents

can be accessed through myAccount, by following these steps:

>

>

>

WHAT IS A TAX CREDIT CERTIFICATE?

Your Tax

Credit Certificate (TCC) lists for the tax year, your::

>

>

>

HOW IS MY INCOME TAX CALCULATED?

See the video on our Youtube Channel for step by step answers to PAYE questions and guides through the screens on Revenue PAYE System for Workers. Explained in detail using simple terms for all PAYE workers to understand.

If you are

paid weekly, your Income Tax (IT) is calculated by::

>

>

>

>

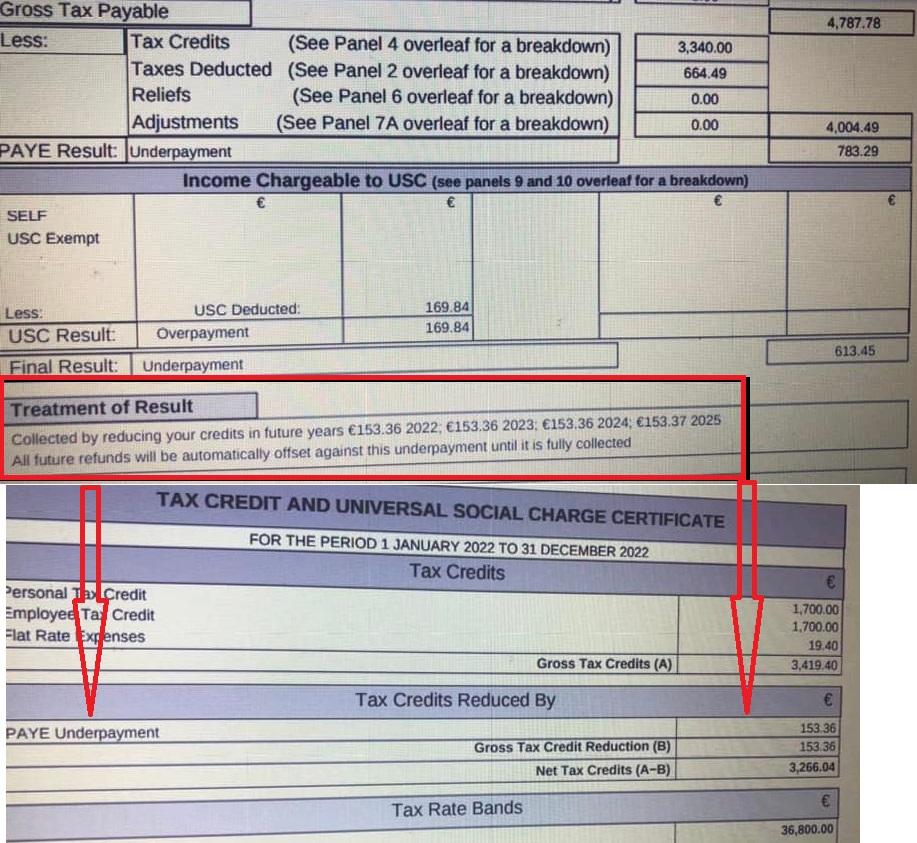

WHAT DOES PAYE UNDERPAYMENT MEAN?

The main reason for this is

for Tax owed if you were on Social Welfare benefit during the

year. To check have a

look at the Statement of Liability you received at the beginning

of the year (you can see statement of liability in

documents) and you should see this amount on it if this relates

to the reduction of your credits over 4 years.

WHAT DOES TAX CREDITS REDUCED BY MEAN?

If you happened to be receiving a

taxable Department of Social Protection Payment (DSP) during the

year then your tax credit cert will be reduced by 20% of the

weekly amount of your benefit multiplied by 52. So, for example

if you were on a SW payment at 250 per week your credits will show a

reduction of €2600. The same would apply to illness and

maternity benefit.

WHAT DOES RATE BAND IS DECREASED BY MEAN?

If you happened to be receiving a

taxable Department of Social Protection Payment (DSP)

during the year then your tax credit cert will be reduced by the

weekly amount of your benefit multiplied by 52. So, for example

if you were on a SW payment of 250 per week your rate band is decreased by

€13000. The same would apply to illness and maternity benefit.

------

Tax Treatment of

Employment Flat Rate Expenses

During the course of Revenue’s review of

its flat rate expenses regime in 2018 and 2019, a number of

policy issues emerged. Revenue decided to defer its

implementation of any planned changed to the regime pending the

outcome of a review of a number of these policy issues. The policy issues are:

> The differing tax treatment of expenses

as between the self-employed and employees.

>

>

A commitment was made to examine these

issues as part of the Tax Strategy Group (TSG) and, if

appropriate, to include options for legislative change.

Waitresses & Kitchen Porters Flat Rate

Expenses.

We have been

doing some analysis of Tax Credits awarded to particular jobs in

respect of flat rate expenses. When our analysis is completed,

we will be putting together an interactive tool to enable people

to easily see what tax credit PAYE workers can claim for flat rate

expenses relating to their job.

Thus far there are two points worth noting

from our analysis:

2. The credits for Waitresses and Kitchen

Porters not providing or laundering their uniforms is less for

those working in hotels than for those working in Hospitals.

------

The PPS Number Entered Cannot Access MyAccount

PHASING OUT OF W RSI/PPS NUMBERS

These numbers are being slowly phased out and W numbers have not been issued since 1999. Boyle Payroll Project Management have assisted many women particularly widows in receipt of a private widows pension with income tax issues due to issues associated with the W number. Anyone in this situation may PM me if they have difficulty getting the matter resolved by their pension provider, Revenue or DSP.If your RSI/PPS number is the same as your husband’s RSI/PPS number but the last letter is W, you must get a new RSI/PPS number in these circumstances:

If your spouse is deceased

If you have a RSI/PPS number ending with W

and you cannot access the Local Property Tax online system using

this number, you may need to request a new number.

If you are changing your W number for a new

RSI/PPS number, you do not need to go through the same

application process as everyone else. To get your new number or

to be re-instated with your old number contact the Client

Identity Section in the Department of Social Protection (DSP).

The phone number is (071) 967 2616 or Lo-call 0818 927 999.

------

Cohabiting Couples Income Tax Treatment

At the moment cohabiting couples have

both incomes assessed in a means test for social assistance

payments, yet a cohabiting couple cannot claim or transfer

unused tax credits between themselves as jointly assessed income

tax couples can. Payroll Matters in Ireland supports the claim

that co-habiting couples should be treated fairly within the

PAYE taxation system.

The tax system in Ireland does not treat cohabiting couples the

same as married couples or civil partners, and it is unfair for

them and for those with children. The basis for the current tax

treatment of married couples derives from the Supreme Court

decision in Murphy vs. Attorney General (1980). This decision

was based on Article 41.3.1 of the Constitution where the State

pledges to protect the institution of marriage. The decision

held that it was contrary to the Constitution for a married

couple, both of whom are working, to pay more tax than two

single people living together and having the same income. The

taxation system has changed somewhat since 1980 and this

legislation needs to be revisited. Tax legislation provides that

cohabiting couples are assessed as single individuals and each

cohabiting partner will be entitled to the basic personal tax

credit.

------

Complete Income Tax Return

You complete a tax return where you wish

to:

1.

2.

3.

4.

Details Required to Complete Income Tax Return

1. Personal Details and claim for Tax Credits, Allowances and Reliefs for the year

4. Income from Fees, Irish Rental Income, Covenants, Distributions, etc.See the video on our Youtube Channel for step by step Guide How to Complete Income Tax Return 2023 - Summary Level ------

Split Income Tax Credits Between Jobs or Private Pensions

Individuals or jointly assessed couples

who have more than one active job or private pension can amend

how tax credits and rate bands are divided. You can divide your

tax credits, tax rate band and USC rate band between your jobs

in any way you want

In Manage Your Tax, scroll down and

you will see "How your tax credits and rate band are currently

divided". There are two tabs – PAYE and USC and they can be

accessed by clicking on the relevant tab. The PAYE tab gives

details of a customer’s standard rate cut off point and overall

tax credits. Details of a sample person’s tax credits, and rate

bands are shown in the picture below. Where a person has more

than one job, the standard rate cut off point and tax credits

applicable to each job is shown.

By clicking the ‘edit’ above where the

employments are listed, you can split tax credits and rate bands

between jobs & private pensions to avoid overpaying tax in one

employment and having to wait for the end of the year to claim

it back. Individuals and jointly assessed couples who have only

one active job will not have this link on the navigation bar.

Singly assessed individuals or jointly

assessed couple can amend how their tax credits and rate bands

are allocated by clicking on the ‘Divide tax credits’ link on

the navigation bar. To ensure that your tax credits and rate

bands are appropriately allocated across different jobs, you

will be asked to estimate your gross income for each job and

your spouse or civil partner’s jobs, where appropriate. This is

to ensure that you pay the right amount of tax during the year

(and no underpayment or overpayment arises) Where you are unable

to estimate your income, you should click on the ‘Unable to

Estimate’ box. If you have made changes to your record and/or to

your spouse’s or civil partner’s record and you are unable to

provide an estimate of their income for at least two of their

jobs, you will be asked to select their main job i.e., the job

with the highest income. The adjustments to your tax credits

and/or rate bands will be made against this job. If you provide

an estimated income for one job only, the adjustments will be

made against that job. If you have made no changes to their

records but want to make changes to how their tax credits and

rate bands are divided must provide an estimate for at least two

of your jobs (if relevant). A re-allocation of tax credits and

rate bands will only take place amongst jobs where an income has

been provided. You will have the option of not accepting the

allocations done automatically for them. When this happens, you

will be asked how you want your tax credits and rate bands to be

divided.

Divide Tax Credits and Rate Bands Equally Between Employments

Where you estimate your income, you will

be given the Revenue recommended allocation, but you will also

have the option to divide equally. Where the customer cannot

estimate their income, the divide option will then be provided.

If a customer opts for an equal split, this request will process

automatically. If you are happy with this allocation select

‘Proceed with Recommendation’ if you would

like to make additional changes "Proceed with Different

Recommendation"

------

Inform Revenue That You Are A Medical Card Holder

In cases

where the HSE have not already done so, Payroll

Matters in Ireland continues to remind medical card holders they

must inform Revenue that they have a medical card, for the

reduced rate of Universal Social Charge to be applied to their

payroll. There are a couple of ways for medical

card holder to inform Revenue to apply the reduced rate of USC:

You can call into or phone your Local Revenue Office. Calling in

to Revenue offices may not be an option post Covid-19

restrictions.You can do it on line by going into My Enquiries on the top

right hand corner of the Home Screen

In the Enquiries Record go into Add New Enquiry at the bottom of the page

Your email address will appear in the box underneath the

Enquiry Details. You are asked to re-enter your email address to confirm. Attach a copy of your Medical Card and "Submit".

------

Local Property Tax (LPT)

Your property is liable for Local Property Tax (LPT) in the current year if it is a residential property on the valuation date of 1st November 2021. Revenue contacts property owners directly, to explain the three things they need to do to meet their LPT obligations:

1. determine the market value of their

property as at 1st November

2.

3.

LPT is a self-assessed tax. This means

that you need to self-assess the value of your property at 1st

November 2021. The valuation of your property on this date will

determine the amount of LPT you pay for 2022 and for the three

years from 2023 to 2025. Revenue has provided an interactive

tool and information to help you determine the value of your

property and meet your LPT obligations.

Many people do not know how to access details regarding notifications they have been receiving from Revenue. Because of the number of queries already received from people not used to using online services, Payroll Matters in Ireland are complementing Revenue's and Citizens Information guidance by assisting people with issues they may encounter during this process. The Facebook group Payroll Matters in Ireland is voluntary and welcomes people living in Ireland to become members. Some people think because it is a group there may be a cost involved, which is not the case.

1. Valuation Bands and Basic Rates for Valuation Period from

2022 to 2025

2.

Valuing Your Property

The tax is based on the chargeable value

of a residential property. You can do this exercise now. You do

not need to wait until the 1st Novemebr. The chargeable value is

defined as the market value that the property could reasonably

be expected to be sold for on the open market now. You can read

about

how to value your property for Local Property Tax.

Logging in to MyAccount on Revenue

It would appear from feedback received on a post about the LPT on the Facebook group that Revenue are using hard copy mail via the post for some people and soft copy e-mail for others to explain the process to people. To login to your MyAccount on Revenue to see the notification you must be registered. Once you have logged in using your PPS No, DOB and Password and ticked the box to indicate that you are not a robot you will be brought to the Home screen.

View your Local Property Tax Notification

Look in My Documents

Look at unread documents or if you have viewed it already look at LPT 2022 Return.

The Local Property Letter Sample. You will need the property ID and PIN number when accessing your LPT on Revenue for arranging Payment.

The valuation of your property will

determine the amount of LPT you pay for 2022 and for the three

years from 2023 to 2025. Revenue has provided an

interactive tool and information to help you determine the

value of your property and meet your LPT obligations.

Valuation bands and basic rates for

valuation period from 2022 to 2025

Local Adjustment Factor for Local Property Tax

Local authorities can vary the basic LPT

rate on residential properties in their area. These rates can be

increased or decreased by up to 15%. This is known as the local

adjustment factor.Residential properties of the same value in

different local authority areas may pay different amounts of

LPT, depending on whether the local authority has applied a

local adjustment factor or not.Many people have queried the

accuracy of the interactive tool with Payroll

Matters in Ireland and this is quite understandable. There is

a second table for adjustments depending on where the property

is located. You can refer to the LPT Local Adjustment Factor for

each Local Authority in the table below to check if your LPT

charge for 2022 is different from the basic rate.

Now that we have gone through the steps of determinining your

basic rate and adjusted it in accordance with the Local

Adjustment Factor the next step is submit your valuation on or

before 7th November and arrange to pay the tax.

How to Pay Local Property

Tax (LPT)

You will need your Property ID and PIN to

pay your LPT. You can choose to make one single payment, or you

can phase your payments in equal instalments. You can read about

how to pay your LPT on Citizen’s Information You can log in to

the LPT On-line system to view your Local Property Tax record

and to pay any arrears (using your PPSN, Property ID and PIN).

You can also access LPT through Revenue's myAccount and ROS

services. You can contact the LPT helpline for assistance.

Queries can also be sent to Revenue through MyEnquiries.

------

Parent’s Benefit

Parent's Benefit is a payment for

people in employment to allow them to take time off work, up to

five weeks, to care for their child. This leave may be taken any

time in the first 24 months after they were born. Parent's

Benefit leave must be taken in minimum blocks of at least one

week. These weeks can be combined up to a maximum of five weeks

depending on their circumstances.

Parent’s Benefit was extended from

two weeks to five weeks in April 2021. Parents who originally

availed of the two weeks can now apply for the additional three

weeks benefit

Parent’s Benefit is paid at the same rate as Maternity,

Paternity and Adoptive benefits. It is

available for both parents to allow them to spend more time with

their new-born children during these important and formative

years or with their adopted children.

------

Employment Status of Employee or Self-Employed Determination

Employee on Pay as You Earn (PAYE) V

Self Employed on Relevant Contracts Tax (RCT)

The following checklists give a general

overview of how to determine employment status and determining if a

person is an employee or a subcontractor.

A worker is normally an employee if they:

1.

are directed by someone on how, when, and

where to work.

2. have set working hours.

5. supply labour only.

6. cannot subcontract the

work.

7. are covered under the

employer’s insurance.

8. work for only one or two

employers.

> Employers are responsible for the

collection and payment of employees Income Tax (IT), PRSI and USC.

> Employees work under your contract of employment.

> Employees may be entitled to some DSP benefits.

> Employees receive the rights and entitlements associated with their

employment.

A worker is normally self-employed if

they:

1.

control how, when and where the work is done.

2. control their working

hours.

3. are exposed to financial

risk.

4. control costs and

pricing.

5. can hire other people to

complete the job.

6. provide their insurance

cover.

7. own their business.

8. can provide the same

services to more than one person or business at the same time.

What to do after determination of self-employed status?

> Subcontractors are regarded as

self-employed.

> Self-employed persons are responsible for the payment

of their own Tax, Pay Related Social Insurance (PRSI) and Universal

Social Charge (USC).

Self-employed persons must:

a.

Register for all appropriate taxes.

b. Pay preliminary tax.

c. File Income Tax

returns towards the end of the year, for which they

must keep receipts for things that can reduce tax.

d. Self-employed persons

may be entitled to some Department of Social Protection (DSP)

benefits but are not entitled to holiday pay or protection from

unfair dismissal.

e. Self-employed

persons are engaged under a relevant contract.

f.

Self-employed people may have to employ an accountant to do tax and

VAT returns.

Relevant Contracts Tax (RCT)

Self-employed persons in the construction

industry may be a principal contractor or a subcontractor (or both).

RCT applies when a subcontractor is hired by a principal contractor

to carry out construction operations under a relevant contract. All

RCT transactions are submitted through the Revenue Online System

(ROS).

A subcontractor enters a relevant contract with a principal

contractor in the construction, forestry, or meat processing

industries. This contract is not a contract of employment and a

subcontractor must give the principal contractor the details they

need to register the relevant contract with Revenue.

The RCT tax rate will depend on A subcontractor compliance record

with Revenue. The three tax rates in the RCT system for

subcontractors apply as follows:

1.

an up-to-date tax compliance record: 0%

3. a poor tax compliance

record, or for those who have not registered with Revenue: 35%.

------

Band 1 Credit Reduction

A person’s standard rate cut-off point, and credits can be reduced by Revenue, and depending on the amount of the reductions, they may also have a band 1 credit reduction. This arose in 2021 for thousands of recipients of the Pandemic Unemployment Payment PUP. A message shows on their Tax Credit as follows: “Tax Credits Reduced by DSP PUP Payment”. When the tax credit reduction is greater than the tax credits a person has, this will end up as a negative tax credit and a further reduction of the tax band is made to offset this. The Band 1 Credit Reduction is derived at by multiplying the the negative credit by 5.

Tax Credits Reduced by

DSP Payment

In 2021 with the process of

taxing

DSP benefits

in real time the

Department of Social Protection notifies Revenue of

benefit amounts paid to recipients. Revenue reduces the person’s

tax credits and 20% standard rate cut-off point SRCOP, by the weekly

amount of DSP benefit multiplied by 52. So, for example someone paid €350

per week unemployment benefit will have their Tax

credit reduced by €3,640 and SRCOP is reduced by €18,200 (350*52).

€18,200 * 20% = €3,640. The adjusted tax credits and the 20% SRCOP

are applied on a Week 1 / Month 1 basis. For those seeing a:

Total Tax Credits (A-B)

of - €340 means that

Revenue is attempting to reduce their Tax Credits by €3,640 when

they only gave them €3,300. It is like Revenue gave them 3 apples

and are trying to take 5 back from them.

Tax Credits Reduced by DSP PUP Payment

3,640

Gross

Tax Credits Reduction

(B)

3,640

Total Tax Credits (A-B) -340

Adjustment 340

Rate Band 1 36,300

This rate band is decreased by:

DSP PUP Payment 18,200

Band 1 Credit Reduction 1,700

The amount of your income taxable at 20% 15,400

The Band 1 Credit Reduction of 1700 is arrived at by

multiplying 340 by 5. (20% of 1,700 = 340)

------

Public Holidays

Ireland

Public holidays may

commemorate a special national day or other event, for example,

Saint Patrick's Day (17th March) or Christmas Day (25th December). There

are currently 10 public holidays in Ireland in the year. On a public

holiday many businesses and schools close. Most businesses in the

hospitality sector will remain open on public holidays. Other

services, for example, public transport still operate but often with

restricted schedules.

See the video on our Youtube Channel for Pay Entitlements Calculator Public Holiday Statutory Entitlement Calculator - Step by Step Guide on How to Complete it.

New Year's Day (1st January)

First Monday in February, or 1st February if the date falls on a

Friday

Qualifying Rules for Pay

Entitlement

A person’s entitlement to

public holidays is set out in the

Organisation of Working Time Act 1997.together with

the appropriate rate of daily pay.

A paid day off on the public

holiday.

An additional day of annual leave.

An additional day's pay.

A paid day off within a month of the public holiday.

Employees may ask employers

at least 21 days before a public holiday, which of the alternatives

will apply. If the employer does not respond at least 14 days before

the public holiday, employees are entitled to take the actual public

holiday as a paid day off.

Public Holidays Falling

on a Weekend:

If a public holiday falls on

a weekend, workers do not have any automatic legal entitlement to

have the next working day off work. If a public holiday falls on a

day that is not a normal working day for a business (for example, on

Saturday or Sunday), employees are still entitled to the benefit for

that public holiday by one of the following.

A paid day off within a

month of the public holiday

Public Holidays on an Employee Normal Working Day

Where the public holiday

falls on a day on which the employee normally works, the employee is

entitled to a full day’s pay for the public holiday, if they do not

work on the day i.e., as if they had done their normal hours on that

day. If they work on the holiday, they should also get their usual

pay on top of the public holiday entitlement.

Public Holidays on an

Employee Non-Working Day:

Where the public holiday

falls on a day on which the employee does not normally work, the

employee is entitled to one-fifth of his/her normal weekly wage for

the public holiday.If weekly pay varies, then the employer uses an

average of the weekly pay over the last 13 weeks prior to the public

holiday and divides it by five.

Part-time Employees

When an employee has worked

for an employer at least 40 hours in the 5 weeks before the public

holiday and the public holiday falls on a day the employee normally

works, the employee is entitled to a day's pay for the public

holiday. If they are required to work that day, they are entitled to

an additional day's pay.

Bank Holiday

Bank holidays are sometimes referred to

as public holidays and vice versa which causes endless debate and

confusion about pay, especially at Easter and Christmas time. There

is already enough confusion about entitlement to bank holiday pay in

Ireland and what days are bank holidays. For example, many people

are unsure if Christmas Eve and New Year’s Eve are bank holidays.

Christmas Eve and New Year’s Eve are not bank holidays or public

holidays.

Public Holidays Should only be Referred to as Public Holidays

Public Holidays are Legislated for by

Government by means of the

ORGANISATION OF WORKING TIME ACT, 1997.

There is no mention in any part

whatsoever of this Act of referring to Public Holidays as

anything other than Public Holidays. For payroll purposes any reference to a

Public Holiday other than its official name only confuses

employees and makes it more difficult for PAYE workers to

understand

------

See the video on our Youtube Channel for Days on which Statutory Public Holiday Entitlements Apply Days on which Statutory Public Holiday Entitlements Apply and Days like Good Friday that they don't.Taxation of Maternity Benefit

Maternity Benefit, Adoptive Benefit, and

Health and Safety Benefit (including any increases for dependents)

are liable to Income Tax. These payments are not liable to Universal

Social Charge (USC) or Pay Related Social Insurance (PRSI).

On this post, all further references to Maternity Benefit can be

assumed to also mean Adoptive Benefit, and Health and Safety

Benefit. The tax treatment for these benefits is similar.

How Maternity Benefit is taxed.

The Department of Social Protection (DSP)

gives Revenue details of Maternity Benefit payments. If you receive

Maternity Benefit and you are a Pay As You Earn (PAYE) taxpayer,

Revenue collect the tax due.

Maternity Benefit received is on a 'Week 1 basis'.

This means the adjusted tax credits and rate band are applied on a week-by-week basis. You can see this on your Tax Credit Certificate (TCC). Revenue will make a revised Revenue Payroll Notification (RPN) available to your employer.

Full wage received and Maternity Benefit

paid to employer.

The difference

between the wage paid to you by your employer and the Maternity

Benefit paid to your employer is subject to Income Tax, USC and

PRSI.

'Top-up' wage and Maternity Benefit

received.

Only the wages actually paid by your

employer are subject to Income Tax, USC and PRSI.

Only Maternity Benefit received (no wage

paid)

A revised Revenue Payroll Notification (RPN)

will be available, on request, from your employer on a Week 1 basis.

A tax refund may be due to you. As the RPN is on a Week

1 basis, your employer cannot make this refund. You should contact

your Revenue office to see if we can remove the Week 1 basis.

Maternity Benefit

claims that span two tax years

Y

ou may be on maternity leave that spans two tax years (for example, November to April). Maternity Benefit payable in Year 2 is taxed by reducing the tax credits and rate band. Revenue do this on a ‘cumulative basis', from the beginning of Year 2. This means that Revenue spread the tax due on the Maternity Benefit for Year 2 over the full tax year.Couples taxed under joint assessment.

You may not have enough tax credits and rate

band to allow collection of the full amount of tax due. Revenue will

collect the balance by reducing your spouse’s, or civil partner's,

tax credits and rate band.

Mary has a full time job with the same

company for the past few years

Annual Tax credits

Weekly Tax credits

Annual rate Band

€40,000 taxed at 20% Balance taxed at 40%

Weekly Rate Band

Maternity Benefit

€250 p.w. * 52 = €13,000

Annual Tax Rate Band Reduction =

€13,000

Revised 20% Rate Band = €40,000

- €13,000 = €27,000

Annual Tax Credit Deduction 13,000 * 20% = €2,600

Revised Tax Credits €3,550 -

€2,600 = €950

Revenue issue an

updated Revenue

Payroll Notification (RPN) to Mary's employer,

Weekly Tax Credit =

Weekly Rate Band =

Taxed at 20%

Taxed at 40%

Gross tax

Deduct tax credits

Tax payable €

31.73

Her Maternity Pay is not subject to USC or PRSI

Returning to Work After Maternity Leave

Mary returns to work in September.

Following her last payment DSP tells Revenue that Mary's Maternity

Benefit payments have stopped. Revenue adjust Mary's tax credits and

rate band by removing the Maternity Benefit annualised reductions

and make a revised RPN (on a week 1 basis) available to Mary's

employer.

Weekly Tax Credit =

Weekly Rate Band =

Balance taxed @40%

Mary returns from maternity leave on

1st September. On her first full weeks pay day after returning her gross pay

is €700, and her employer calculates her weekly IT as follows on the

basis that the above Tax Credit Certificate was received by Mary's

employer prior to the running of their payroll:

Mary's IT payable from

1st September.

Taxed at 20%

Taxed at 40%

Gross tax

Deduct tax credits

Tax payable

€ 71.73

Mary’s

gross pay of €700 is also subject to USC and PRSI as normal. Mary

was not paid by her employer during her maternity leave and her tax

credits exceed the tax due on her Maternity Benefit. A tax refund

may be due to Mary and she should submit an online income tax return

at the end of the year through myAccount.

Anne has a full time job with the same

company for the past few years

Annual Tax credits

Weekly Tax credits

Annual rate Band

€40,000 taxed at 20% Balance taxed at 40%

Weekly Rate Band

A

Maternity Benefit

€250 p.w. * 52 = €13,000

Annual Tax Rate Band Reduction =

€13,000

Revised 20% Rate Band = €40,000 - €13,000

= €27,000

Annual Tax Credit Deduction 13,000 * 20% = €2,600

Revised Tax Credits

€3,5

Revenue issue an

updated Revenue

Payroll Notification (RPN) to Anne's employer,

A

Weekly Tax Credit =

Weekly Rate Band =

A

The

Taxed at 20%

Taxed at 40%

Gross tax

Deduct tax credits

Tax payable € 71.73

Her Maternity Pay is not subject to USC or PRSI

Returning to Work After Maternity Leave

Anne returns to work in August.

Following her last payment DSP tells Revenue that Anne's Maternity

Benefit payments have stopped. Revenue adjust Anne's tax credits and

rate band by removing the Maternity Benefit annualised reductions

and make a revised RPN (on a week 1 basis) available to Anne's

employer.

A

Weekly Tax Credit =

Weekly Rate Band =

Balance taxed @40%

Anne returns from maternity leave on 1st

August. On her first full weeks pay day after returning her gross pay

is €700, and her employer calculates her weekly IT as follows on the

basis that the above Tax Credit Certificate was received by Anne's

employer prior to the running of their payroll:

Annes IT payable from 1st August.

Taxed at 20%

Taxed at 40%

Gross tax

Deduct tax credits

Tax payable

€ 71.73

Anne’s gross pay of €700 is also subject to USC and PRSI as normal. Anne was paid by her employer during her maternity leave and her tax credits did not exceed the tax due on her Maternity Benefit. If the DSP informed Revenue in real time and there were no delays in processing the revised RPN's the Anne's tax would be balanced. However in the real world payroll time periods and DSP periods are not always in synch and there may be delays in the information passing from the DSP to Revenue or from Revenue to Anne's employer in which case a tax underpayment or overpayment may occur in which case Anne should submit an online income tax return at the end of the year through myAccount

.Difficulties with PROCESS FOR TAXATION OF SOCIAL WELFARE BENEFITS

From 1st December 2022, the Payment of Wages

(Amendment) (Tips and Gratuities) Act 2022 introduces new rules as

to how employers will have to share tips, gratuities, and service

charges amongst employees. It will also make it illegal for

employers to use these to form part of the basic wages. Some key features: 1. Employers cannot use tips and gratuities

to ‘make up’ contractual rates of pay and cannot make a deduction

from a person’s wage in relation to tips and gratuities. 2. Workers are legally entitled to receive

electronic tips and gratuities and they must be distributed in a

fair manner. The employer must provide a statement to workers

showing the amount of tips obtained in a period and the portion paid

to the individual employee for that particular period. 3. An employer cannot retain any share of

electronic tips. However, there may be circumstances e.g., to pay

tax, or bank charges arising from providing electronic modes of

tipping, or only where the employer regularly performs to a

substantial degree the same work performed by some or all the

employees, where such an amount may be deducted that is fair in the

circumstances. 4. Businesses must clearly display their

policy on how tips, gratuities and service charges are distributed. 5. “Platform workers”, who are not direct

employees, are included. 6. Any charge called a “service charge” or

anything that would lead a customer to believe it is a charge for

service, whether received electronically or by any other means, will

have to be distributed to staff as if it were a tip or gratuity

received by electronic means. 7. While employers will be required to include

detail on how cash tips are dealt with when displaying their policy

towards tips and gratuities, there will be no other regulation of

‘cash tips’.

Tips and the Payment of Wages (Amendment) (Tips and Gratuities) Act

2022.

What is a “tip or gratuity”?

A ‘tip or gratuity’ is a voluntary payment

made by a customer to, or left for, an employee or group of

employees which they intended or assumed that the payment would be

kept by the employee or shared with other employees.

The new rules apply to employers in the

following service areas:

1. The sale of beverages (including

intoxicating liquor) or food for consumption on the premises at

which such beverage or food is sold.

2. The sale of beverages (including

intoxicating liquor) or food by means of casual trading.

3. The accommodation of overnight guests on

a commercial basis in a hotel, guesthouse, hostel, bed and

breakfast, self-catering accommodation facility or any similar

accommodation facility.

4. Providing guided tours.

5. Carrying out non-surgical cosmetic

procedures including the following: cosmetic nail care; nail

styling; skin care; hair care; hair styling; tattoo services; and

piercing services.

6. Gaming.

7. The provision of services as a licensed

bookmaker.

8. Providing transport services by means of

a public service vehicle.

If an employee is not satisfied with the

distribution policy the employee may take a case to the Workplace

Relations Commission (WRC) for adjudication as to whether the

distribution is fair in the circumstances.

------

Payroll Matters in Ireland Blog Page 2

© Copyright Boyle Payroll Project Management